november child tax credit amount

IRS just sent out another 500 million to Americans. The October child tax credit payment will arrive this week.

Child Tax Credit November Payment Is Second From Last What To Know

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

. Thanks to the American Rescue Plan those payments skyrocketed to 3600 for kids under 6. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Families will see the. It is levied at six percent and shall be paid on The Internal Revenue Service IRS is providing temporary relief for the. If your 2021 income exceeds that threshold you may need to return a portion of the tax credit.

Families that did not receive monthly payments can still claim the full amount of the Child Tax Credit they are eligible for when they file taxes. The maximum amount of the child tax credit per qualifying child that can be refunded. Thats an increase from the regular.

Your amount changes based on the age of your children. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. Moreover the advance payments comprise roughly half of the total child tax credit for 2021.

The IRS is paying 3600 total per child to parents of children up to five years of age. Child tax credit deadline coming that could give up to 1800 per child to some families on Dec. November child tax credit.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. The maximum amount of the child tax credit per qualifying child. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

The IRS has confirmed that theyll soon allow. As part of President Joe Bidens American Rescue Plan qualifying families have been receiving monthly payments worth up to 300 per child. Half of the total is being paid as.

150000 if married and filing a joint return or if filing as a qualifying. For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. Meanwhile parents with children between the ages of six and 17 will receive up to 1500 in six monthly payments of.

The full expanded child tax credit amount is 3000 for each qualifying child between ages 6 and 17 at the end of the 2021 tax year and 3600 for each qualifying child 5. 150000 if you are. Heres whos getting it.

Why have monthly Child Tax Credit payments. That drops to 3000 for each child ages six through 17. That includes an enhanced child tax credit that brought the total sums to 3600 per child under age 6 and 3000 per child under 18 up from 2000 per child.

The Child Tax Credit income limits are as follows. While the deadline to sign up for monthly Child Tax Credit payments this year was November 15 you can still claim the full credit of up to 3600 per child by filing a tax return next year. 112500 if you are filing.

By declining the monthly advance payments of Child Tax Credit CTC parents who are eligible can claim the full 2021 Child Tax Credit up to 3600 for a child under 6 and. For both age groups the. The IRS bases your childs eligibility on their age on Dec.

However if youre making under 40000 per year you dont need to pay back. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Child Tax Credit Updates November Payments Starting Today Marca

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

One Week Until November Child Tax Credits Are Paid Out What Time You Ll Get Them Explained The Us Sun

Stimulus Update Some Child Tax Credit Payments May Be Lower In October November And December Al Com

Brian Barnwell On Twitter Please Note The Important Child Tax Credit Deadline Of November 15 2021 Please Visit The Https T Co Madzzfnf0u To Sign Up For Payments Or To File A Tax Return By

Parents Still Have Time To Claim Child Tax Credit Of Up To 3 600

Next Child Tax Credit Payment Opt Out Deadline Is Today

Child Tax Credit Update For 2022 Dailynationtoday

What Is The Child Tax Credit Payment Date In November 2021 As Usa

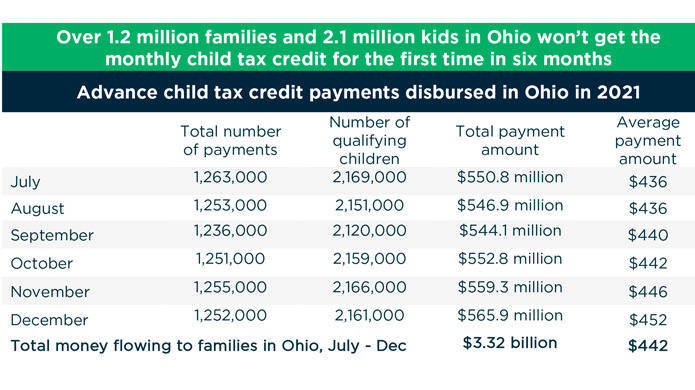

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

Claim Your 2021 Child Tax Credit By November 15 The Morning Bell

Child Tax Credit Why November Payment May Be Less This Month 10tv Com

Child Tax Credit Delayed How To Track Your November Payment Marca

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

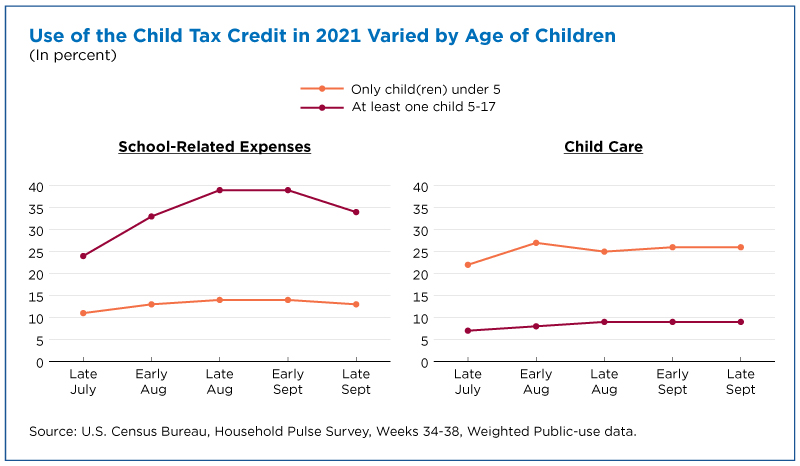

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses